Safety

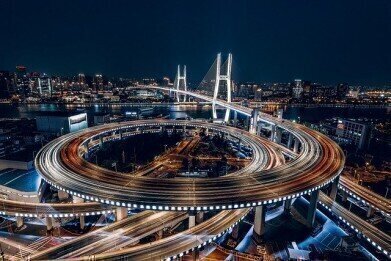

China Recovery Provides a Boost for Oil

Apr 13 2020

After the COVID-19 pandemic crippled oil demand and sparked fears over a global surplus, the oil market suffered one of the worst quarters on record. By the end of March US crude was trading at an 18-year low of US$20.09 a barrel. This was largely caused by nationwide factory shutdowns in China, which affected everything from car manufacturers to clothing and electronics warehouses. Now, after months of hibernation the Chinese economy is starting up again and with it has come mild relief for oil prices.

The widespread factory closures triggered a sharp decline in power consumption which corresponded with a drop in oil demand. In the first two months of 2020, electricity consumption dropped by 7.8% year-on-year, a drop that was more drastic than the fall seen during the recession of 2008-09. Experts warned that rapidly increasing oil inventories could quickly exhaust storage capacity, forcing producers into an unprecedented shutdown.

Chinese factories enjoy March revival

While oil prices did suffer enormously, Chinese factories enjoyed a revival in March which helped to stabilise prices. By the end of the month China's Purchasing Managers' Index (PMI) climbed to 52 after falling to a record low of 35.7 in February. PMI of 50 or lower indicates a contraction, which sparked major concerns among analysts.

Oil prices have been further bolstered by an end to the trade war between Russia and Saudi Arabia. Following negotiations made during a video conference, OPEC producers agreed to cut global output by around 10%. This translates to a reduction of around 10 million barrels per day.

"By the grace of Allah, then with wise guidance, continuous efforts and continuous talks since the dawn of Friday, we now announce the completion of the historic agreement to reduce production by approximately 10 million barrels of oil per day from members of 'OPEC +' starting from 1 May 2020," tweeted Kuwaiti Oil Minister Dr Khaled Al-Fadhel.

OPEC deal casts oil a lifeline

In response, oil prices in Asia rose by more than US$1 a barrel during early trading. Global benchmark Brent also climbed by 3.9% to US$32.71 a barrel. US grade West Texas Intermediate also enjoyed a 6.1% price increase, trading at US$24.15 a barrel.

To find out more about how the COVID-19 pandemic is affecting the global oil industry don't miss 'The Only Certainty is Uncertainty for Corona-Stricken Oil Industry' with insight from Dr. Raj Shah, David Phillips and Ms. Shana Braff on behalf of Koehler Instrument Company.

Digital Edition

PIN 25.1 Feb/March

March 2024

In This Edition Safety - The technology behind the ION Science Tiger XT - Safety with ammonia and LOHCs as hydrogen carriers Analytical Instrumentation - Discussion on new tribology te...

View all digital editions

Events

Apr 22 2024 Hannover, Germany

Apr 22 2024 Marrakech, Morroco

Apr 22 2024 Muscat, Oman

Apr 22 2024 Rotterdam, Netherlands

Apr 23 2024 Singapore

.jpg)