Fuel for Thought

APAC LNG companies revisiting strategies to tackle economic slowdown fuelled by COVID-19

May 13 2020

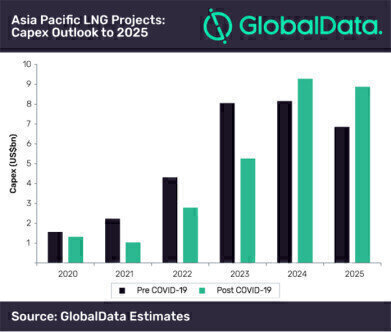

Liquefied natural gas (LNG) imports by the world’s top three consumers – Japan, China and South Korea, and other Asia-Pacific (APAC) countries such as India have taken a hit due to reduced demand and economic slowdown fuelled by the COVID-19 outbreak. Against this backdrop, LNG firms are re-examining their strategies to combat the financial slowdown. This has led to long-term LNG supply contract re-negotiations and cargo deferments by the importing counties, causing supply overhang and resulting in lower LNG prices, says GlobalData, a data and analytics company.

Haseeb Ahmed, Oil and Gas analyst at Global Data, comments: “Low gas prices and LNG supply glut have impacted LNG producers, who are rethinking their capex spends in the upcoming multi-billion-dollar gas projects. Woodside Energy decided to cut down its capex spending for the year 2020, which led to the delay in the Flame Ionization Detector (FID) of Pluto LNG Train 2 project in Australia.

“The expansion of PNG LNG plant in Papua New, operated by Exxon Mobil PNG, is likely to be delayed due to failed negotiations with the government and current market conditions.”

Similarly, the FID of the Barossa gas project, which will backfill the Darwin LNG, has been delayed due to low oil prices combined with COVID-19 pandemic. This also translates to the delay in the project start year as well, by a year. On the brighter side, despite reducing the workforce to stem the spread of the virus, Tangguh Train 3 (operated by BP Berau) is likely to be finished as per schedule, as the project is nearing the end of construction.

Ahmed concludes: “The global lockdown resulting in LNG cargo cancellations and leading producers limiting their LNG production could be the short-term impact on this sector. In the long-term, the emergence of new importers such as Vietnam and the Philippines among others can be seen creating a bigger market for global suppliers in the APAC region. LNG is also expected to play a major role in the energy transition from coal to gas in the region.”

Digital Edition

PIN 25.1 Feb/March

March 2024

In This Edition Safety - The technology behind the ION Science Tiger XT - Safety with ammonia and LOHCs as hydrogen carriers Analytical Instrumentation - Discussion on new tribology te...

View all digital editions

Events

Apr 22 2024 Hannover, Germany

Apr 22 2024 Marrakech, Morroco

Apr 22 2024 Muscat, Oman

Apr 22 2024 Rotterdam, Netherlands

Apr 23 2024 Singapore