Flow Level Pressure

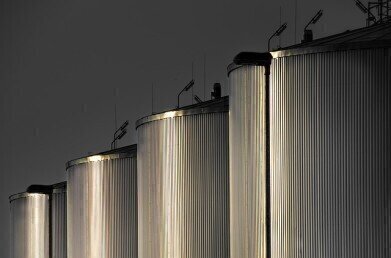

Are US Imports on the Up?

May 22 2017

In early March, a bleak inventory report released by the Energy Information Administration triggered a mass sell-off in oil prices. Almost immediately, the West Texas Intermediate (WTI) slipped to below US$50 a barrel for the first time since December, and continued to hover under the US$50 mark for the next three weeks.

Though despite high inventories, the US has continued to import oil to the point where it’s breaking previously seen levels. Unsurprisingly, this combination didn’t fail to raise its fair share of suspicion. So, what’s behind this unusual trend?

In the USA’s defence, the bearish report was released during refinery maintenance season, which tends to see crude stockpile while utilisation cools off. Furthermore, mass oil imports could be put down to the fact that some refineries are better suited to handling heavier crudes produced outside the USA. As a result, it can be a savvy move for Gulf Coast refiners to import and refine oil, then sell locally or export.

Is an import tax looming?

Other experts take a direr approach, and warn that the combination could signify that the US is preparing for a border adjustment tax. Tamar Essner, lead energy analyst at Nasdaq Advisory Services explains, "I think there are a few things going on here. Of course, a lot of U.S. refineries are geared to take heavy, sour crudes that are imported since most of the domestically sourced crude is light and sweet. I think there is a fear of a border adjustment tax, and refiners are hoarding oil ahead of that.”

The ‘backwardation’ era

Beyond gearing up for a tax hike, Essner muses put the trend down to the fact that the crude oil forward curve has been in contango since November 2014. As a result, there’s been a strong incentive to store oil in vessels for extended periods of time, in the hope of selling it off at higher prices. Now, the market is moving toward backwardation which is making this approach less economical. The US mainland is home to some of the cheapest oil storage on the planet, which seems to have triggered a mass offload onto US shores.

Essner also notes that while current data may indicate an import frenzy, a lot of the deals were made before the OPEC cuts, which means the pace will likely slow over coming weeks.

With import taxes looming, it’s more important than ever for stateside refiners to make the right decisions when it comes to operational efficiency. For a closer look at what factors to consider when investing in equipment, ‘Making the case for wedge flow measurement’ offers expert commentary from Steve Gorvett, Product Manager at DP Flow and Temperature for ABB Measurement & Analytics in the UK.

Digital Edition

PIN 25.1 Feb/March

March 2024

In This Edition Safety - The technology behind the ION Science Tiger XT - Safety with ammonia and LOHCs as hydrogen carriers Analytical Instrumentation - Discussion on new tribology te...

View all digital editions

Events

Apr 28 2024 Montreal, Quebec, Canada

Apr 30 2024 Birmingham, UK

May 03 2024 Seoul, South Korea

May 05 2024 Seville, Spain

May 06 2024 Riyadh, Saudi Arabia