Water/Wastewater

IFAT India 2014: Battling the Water Crisis

May 13 2014

2014 is an important year for India: Parliamentary elections are being held and the results of those elections could mean new impetus that could stimulate the Indian economy and pave the way for needed investments in the environmental sector: India wants and has to urgently improve its inadequate water-supply and sewage infrastructure. According to the experts' forecasts, compared to 2010, demand for water in the country of more than 1.2 billion people will practically double by the year 2050. The water-supply situation is already tense. According to Anna Westenberger, India Correspondent for Foreign Trade and Location Marketing, Germany Trade & Invest (GTAI), "at present, only about half of all urban households have their own potable water connection. However, that says nothing about actual availability: In many of India's major cities, water is only available for a few hours a day—and in many cases, the quality of that water is very poor." Add to that the fact that, according to information from Indian municipalities, up to half of all available water gets lost on its way to the consumer due to dilapidated pipes and theft.

There is also an urgent need for action when it comes to sewage treatment. According to GTAI, only approximately 30 percent of urban sewage is currently treated. Siddharth K. Desai, Director of the Indian pump manufacturer Kishor Pumps, explains: "The treatment plants for domestic sewage are mostly financed by local municipal corporations or municipalities. Delays, quality problems, suboptimal maintenance and water shortages are frequent. Treatment plants that are financed by bilateral or multilateral organizations such as the World Bank, the Asian Development Bank or the Japan International Cooperation Agency, on the other hand, meet international standards and are considerably more successful." According to Desai, a growing number of treatment plants are now also being built by well-known Indian and multinational companies that generally operate them for seven or eight years according to the BOOT (Build, Own, Operate, Transfer) principle. "This is a welcome sign that India's sewage infrastructure is improving", emphasizes Desai.

Frank Hoffmann from the German-Indian Chamber of Commerce, knows that "legal regulations regarding environmental protection in India are sufficient and stipulated threshold values can even be described as very ambitious." In many places, however, the problem is implementation. Hoffmann explains: "Market opportunities for domestic and international environmental technology companies in India depend to a great extent on whether the pollution control boards will be in a position organisationally and with regard to personnel to enforce compliance in the near future." The State Pollution Control Boards and the Pollution Control Committees are responsible for general environmental monitoring at the Indian state and territorial levels.

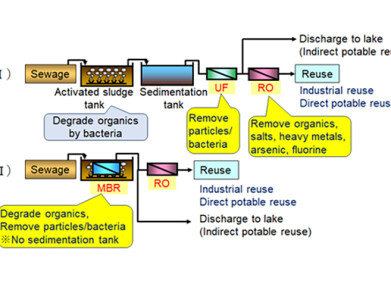

As soon as these organisational obstacles are overcome, high-end solutions will also have good chances in the subcontinent's water-management sector. The consulting firm Frost & Sullivan expects that as the market for water treatment continues to grow in the future, so will demand for reverse osmosis, ultrafiltration and membrane bioreactor systems. Together with the industrial application sector, analysts feel that the overall Indian market for membrane modules could increase from the equivalent of nearly EUR 71 million per year in 2012 to EUR 153 million per year in 2017.

Rapid industrialisation of the country and the worsening water shortage are also increasing the need for water disinfection systems. According to a recent Frost & Sullivan report, this market, which was worth some EUR 39 million in 2012, will grow to nearly EUR 60 million within five years. Besides electrochlorination, experts feel that UV disinfection and ozone systems have very good chances on the market.

Suppliers and consumers of future-oriented technologies meet at IFAT India, India's Leading Trade Fair for Water, Sewage, Refuse and Recycling.

Events

Apr 24 2024 Sao Paulo, Brasil

May 05 2024 Seville, Spain

May 13 2024 Munich, Germany

May 23 2024 Beijing, China

May 23 2024 Beijing, China