Consultancy Services

Merger with RWL Water Forms an Innovative Global Water Solutions Company

May 12 2017

Emefcy Group Limited (ASX: EMC) (“Emefcy”) is pleased to announce that it has signed a Letter of Intent with respect to a proposed business combination with RWL Water (“RWL Water”) that, if consummated, would create a global provider of innovative, distributed water and wastewater treatment solutions. It is anticipated that the proposed merger would substantially accelerate Emefcy’s deployment into China and other key markets, as well as deliver substantial sales synergies between Emefcy and RWL Water products and systems, resulting in continued strong revenue growth, improving gross margins and increased recurring revenue streams. On a combined basis, the two groups would have achieved revenues of US$62 million (A$83 million) in 2016 and anticipate sales in excess of US$90 million (A$120 million) for calendar 2017, 71% of which have already been achieved or are in backlog.

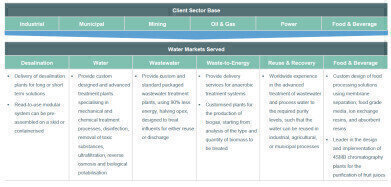

The proposed name of the new global group, subject to shareholders’ approval, would be Fluence Corporation Limited (“Fluence”). Fluence plans to provide a range of products and services for water treatment, wastewater treatment, desalination, waste-to-energy and water reuse and recovery. The combined group would focus on key growth markets including municipal, commercial, industrial, mining, oil & gas, power, food and beverage sectors. Fluence’s wastewater treatment solution plans are centred around Emefcy’s proprietary Membrane Aerated Biofilm Reactor (“MABR”) technology and associated new technology developments. It is anticipated that Fluence would substantially benefit from RWL Water’s recognition as one of the fastest growing water solutions companies in the world. RWL Water has designed and built more than 7,000 successful installations together with strong customer references in more than 70 countries worldwide.

The transaction is subject to agreement on definitive terms, execution of a purchase agreement, Emefcy shareholder approval and other customary conditions.

Potential Transaction Overview

Under the terms of the non-binding Letter of Intent (“LOI”), which was unanimously approved by Emefcy’s Boards of Directors, Emefcy proposes to merge with RWL Water in an all-stock transaction, and issue 100.5 million new Emefcy shares to RWL Water’s owner, an entity controlled by Mr. Ronald S. Lauder. Those shares would be subject to a 2-year lock-up agreement, under which Mr. Lauder would only be allowed to sell the shares under limited circumstances.

The LOI further contemplates that Mr. Lauder (or his controlled entity) will subscribe for US$20 million (A$27 million) in additional Emefcy shares at an expected price of A$0.85 per share representing the 20-day VWAP share price for Emefcy’s shares. That share subscription would be conditioned upon execution of a purchase agreement, the completion of the merger and Emefcy shareholder approval. Following these transactions, and on an undiluted basis, current Emefcy shareholders would own approximately 66% of the merged group, while Mr. Lauder would own approximately 34%.

Upon closing of the transaction, Fluence stock would remain listed on the Australia Stock Exchange.

Creating a Leader in Distributed Water and Wastewater Treatment Solutions

“Subject to completion, we expect this merger to create a clear leader in the global distributed water and wastewater treatment industry, one of the fastest growing sectors of the water market globally,” stated Richard Irving, Executive Chairman. “Emefcy has developed breakthrough technology to substantially reduce the cost of wastewater treatment, but has not yet fully developed its distribution and turn key plant implementation capability. RWL Water has grown rapidly into a world leader in the deployment of water treatment solutions, but now has a new injection of proprietary technologies.

This merger is intended to bring together the strengths of both companies, creating impressive synergies that promise to accelerate the already-rapid growth of each company.”

Henry Charrabé, Chief Executive Officer of RWL Water, noted “We believe that should we complete this merger, Fluence would be well positioned as a global leader in the vast market for distributed and packaged total water treatment solutions. Capabilities of the merged group would cover the full water cycle, from desalination to wastewater treatment to wastewater-to-energy and reuse. The combined company would provide packaged treatment plants with competitive capital cost, rapid deployment capability and economical operating costs. The distributed treatment model enables all communities worldwide in remote or developing regions to have the access to clean water and sanitation they deserve, at a price they can afford, while also offering a compelling model to the developed world. We believe the combined group would have the potential to access this multi-billion market.”

Strategic Rationale

Both Emefcy and RWL Water noted meaningful strategic reasons for pursuing a business combination and creating Fluence. Key factors supporting the intended merger include:

- Each partner brings complementary strengths. RWL Water has strong capability in system design, construction, and deployment. Its brand recognition and marketing strength has already resulted in thousands of deployments in over 70 countries around the world. Meanwhile, Emefcy has developed a breakthrough technology that is “game-changing” in its ability to reduce wastewater treatment operating costs.

-As a combined entity, Fluence would be able to offer customers fully functional “turnkey” solutions that are highly differentiated by proprietary technology, accelerating deployment and commissioning of new plants, particularly important in the deployment of rural wastewater treatment plants in China. The ability to sell packaged turnkey solutions should substantially shorten the sales and implementation cycles, very attractive to its target customer base. With a differentiated solution that offers compelling economic advantages, the future Fluence could be more competitive while also capturing higher margins.

- The parties have already been working together as part of a strategic alliance to pursue the large China market opportunity. Through working together in that alliance, both teams quickly came to the realization that they could potentially achieve a more powerful market position as a combined entity.

The table illustrates the key customer segments and services that Fluence could serve upon consummation of the merger.

Events

Apr 22 2024 Hannover, Germany

Apr 23 2024 Kuala Lumpur, Malaysia

Apr 24 2024 Sao Paulo, Brasil

May 05 2024 Seville, Spain

May 13 2024 Munich, Germany